CleanView Study: Natural Gas the Big Winner in AI Sweepstakes

It has been obvious for some time now that natural gas power generation would emerge as the big winner in the race to power America’s rapidly expanding fleet of AI datacenters. It’s an emerging trend I first wrote about in September of 2024, as it became obvious that wind and solar, even when backed up by stationary batteries, would never be able to meet the 99.999% uptime requirements of these computing behemoths.

Now, studies are emerging which put the numbers to the trend. In the race to fuel America’s AI boom, natural gas emerges as the undisputed champion, powering a seismic shift in data center development. As detailed in Cleanview’s Power Strategies Report, data center operators are ditching unreliable grid connections—plagued by multi-year delays—and constructing their own behind-the-meter (BTM) power plants.

This isn’t a green revolution; it’s a gas-fueled sprint for speed and revenue. With AI data centers raking in $10–12 million per MW annually (that’s $10–12 billion per GW), developers are prioritizing quick deployment over efficiency or eco-hype. The report’s analysis of 46 BTM projects totaling 56 GW—about 30% of planned U.S. data center capacity—paints a clear picture: Natural gas isn’t just filling gaps; it’s dominating the landscape, comprising nearly 75% of identifiable generation equipment (23 GW).

While press releases tout renewables and nuclear, the boots-on-the-ground reality is gas turbines firing up in 2025–2026. This op-ed argues that this trend exposes the hollowness of “clean energy transition” narratives, underscoring how market forces and grid failures are entrenching fossil fuels deeper into our digital future.

Natural Gas’s Overwhelming Dominance in Short-Term Power: Of the 23 GW with specified equipment, ~75% is natural gas-fired, as evidenced by over 35 permit documents and site plans. Developers are scavenging for speed: aeroderivative turbines from aircraft tech, reciprocating engines for rapid ramping, refurbished units from old industrial sites, mobile generators on semitrucks (like xAI’s Memphis setup), and even engines repurposed from cruise ships. Heavy-duty combined-cycle turbines? Forget it—5–7 year lead times make them impractical. Efficiency takes a backseat; as the report notes, “Power generation efficiency is out. Speed to power is all that developers care about.” This gas rush enables billions in early revenue, even if it means higher operational costs down the line.

Explosive Growth Driven by Grid Failures: A staggering 90% of these projects (~50 GW) were announced in 2025 alone, evolving from experimental outliers to industry standard. Two-thirds boast concrete equipment deals with giants like GE Vernova, Caterpillar, Siemens, and Doosan—real commitments amid local pushback and supply chain snarls. Grid delays, often stretching years, have forced this pivot. What started as a “curiosity” (e.g., xAI trucking in generators) is now a blueprint for bypassing bureaucratic bottlenecks, with many sites already buzzing with round-the-clock construction crews.

Clean Energy - Promises Deferred, Gas Delivers Now: Announcements brim with greenwashing—renewables, hydrogen, nuclear—but actual deployments? “Almost entirely gas-fired” in the near term. Clean integrations are shoved to 2028 or later (nuclear could take a decade). The lone standout: Switch’s Citadel Campus in Nevada, with 127 MW solar and 240 MWh storage at a rock-bottom 4.9 cents/kWh, proving renewables can work in ideal spots. But it’s the exception, not the rule. This disconnect between PR spin and permit realities highlights how gas is the reliable baseload keeping AI humming while “sustainable” options lag.

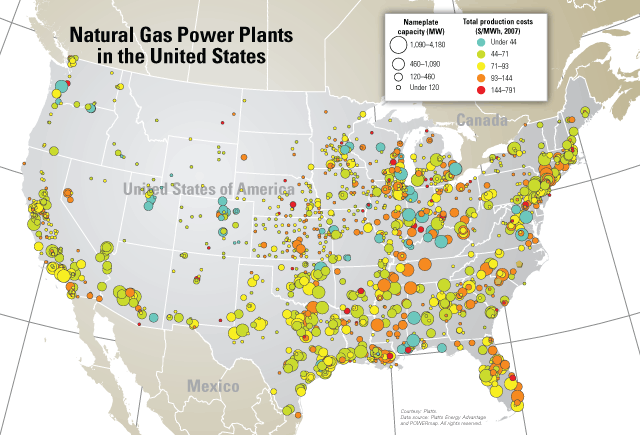

Geographic Hotspots Favoring Gas: 83% of BTM capacity clusters in just five states—mostly red-leaning ones near natural gas hubs with developer-friendly regulations. This enables cheaper, faster builds, amplifying gas’s edge. Blue states’ stricter rules? They’re missing out on the AI gold rush, potentially exacerbating regional divides.

Bottom Line: The era of green virtue-signaling and trillion-dollar subsidies for intermittent power sources that can’t meet baseload needs is ending. Reality has intervened: AI doesn’t run on wishful thinking or solar panels that only work when the sun shines. It runs on electrons that are there 24/7, and natural gas is providing them at scale and speed. Long-term, advanced nuclear, next-gen geothermal, or even breakthroughs in hydrogen could play bigger roles—but only if we stop demonizing the hydrocarbons that make those technologies possible in the first place.

Policymakers should stop chasing unattainable net-zero timelines and start prioritizing energy abundance. Anything less is just more self-sabotage in a world that won’t wait for utopian energy dreams

#NaturalGas #DataCenters #AIPower #EnergyPolicy #GridReform

We have so much natural gas in the gulf coast areas that it really is the best choice for long term, large scale efficient power generation that is base load quality, very efficient in combined cycle mode, small footprint, fast to install and best of all, totally manageable year round!

The business decision by the data center operators transcends their woke and green support for the climate cult. Bottom line you can’t run a data center without reliable power, and that power needs to be at reasonable cost. An education for the climatocatastrophists. Reality sets in.