ConocoPhillips and Marathon Oil will soon join to form the United States’s biggest independent producer of oil and gas.

In a joint release on Wednesday, the companies announced that ConocoPhillips will acquire Marathon Oil in an all-stock transaction with a total deal value of $22.5 billion, which includes the assumption by ConocoPhillips of $5.4 billion of net debt. Marathon Oil shareholders will receive .2550 shares of ConocoPhillips stock for each of their Marathon Oil shares, which represents a premium of 14.7% above the closing price for Marathon Oil common stock as the May 28, 2024 close.

“This acquisition of Marathon Oil further deepens our portfolio and fits within our financial framework, adding high-quality, low cost of supply inventory adjacent to our leading U.S. unconventional position,” Ryan Lance, ConocoPhillips chairman and CEO, said in the release.

Some of us are old enough to remember when Conoco, Phillips Petroleum, and Marathon were three separate companies, all of which were fully integrated majors. Conoco and Phillips, both originally based in Oklahoma, merged in 2002 to become ConocoPhillips.

Ten years later, in 2012, ConocoPhillips spun off its midstream and downstream assets to create Phillips 66, and became America’s largest independent producer. That move came a year after Marathon also split its midstream and downstream segments from its upstream business in May, 2011, thus forming independent producer Marathon Oil and Marathon Petroleum Corporation.

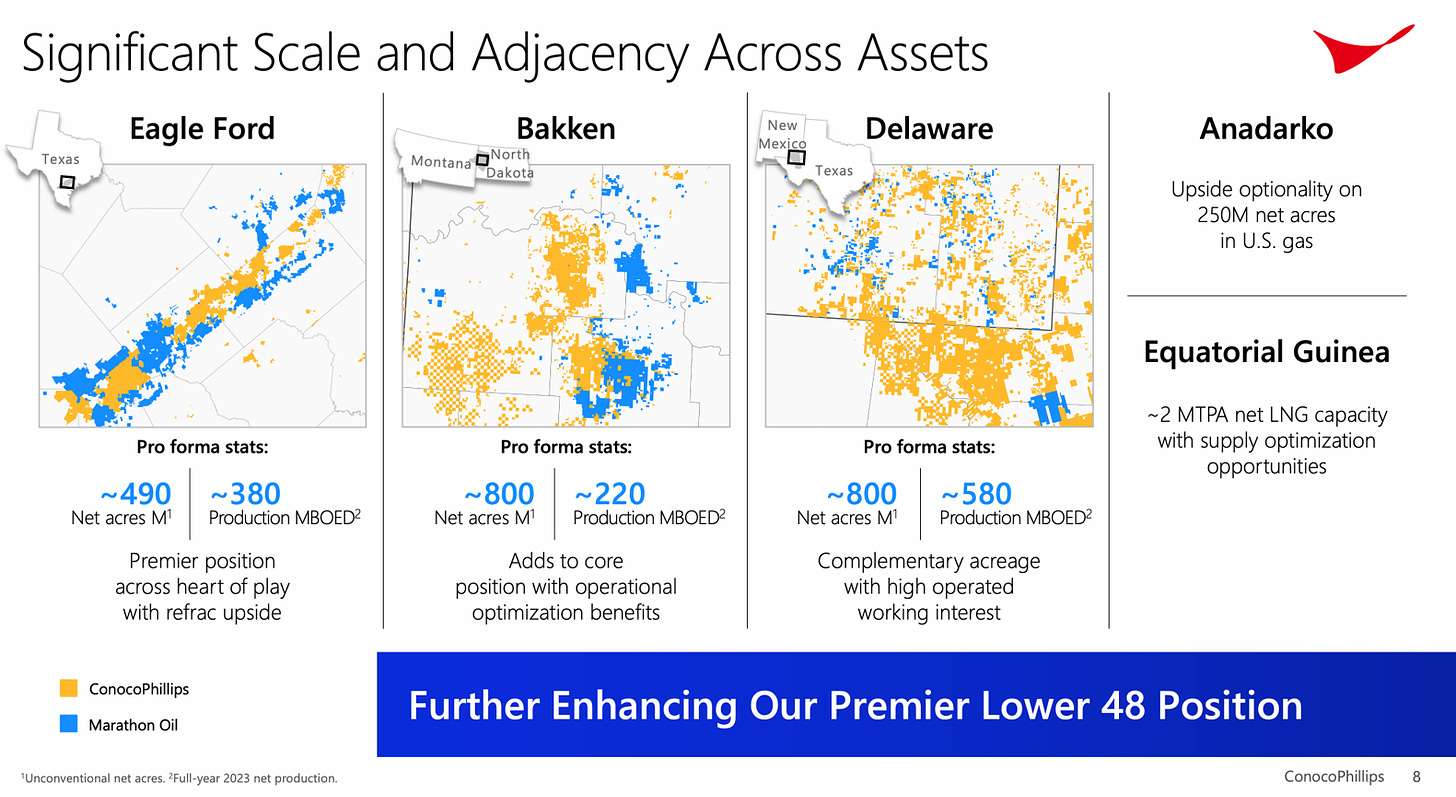

Now, the massive upstream segments that have evolved from all three former majors will combine as a single company focused largely in the Eagle Ford Shale play in South Texas and the Bakken Shale region that spans much of North Dakota and Montana. The New York Times reports that “Wall Street values ConocoPhillips at about $140 billion, making it about 10 times as big as Marathon Oil but around a quarter the size of Exxon.” The Times story also references a Reuters report noting that oil and gas-related M&A deals totaled about $250 billion during 2023, a wave of consolidation that has continued in the first half of 2024.

Marathon Oil chairman, president and CEO Lee Tillman called the agreement a “proud moment” and praised ConocoPhillips’ “track record of long-term investments, differentiated shareholder distributions and active portfolio management.” Tillman added his belief that ConocoPhillips is “the right home” to build on the legacy he and his team have built at Marathon Oil.

ConocoPhillips also announced it will raise its quarterly dividend in Q4, 2024 by 34% to 78 cents per common share, a move it says is independent of the merger with Marathon Oil. Upon closing of the Marathon merger, ConocoPhillips said it also plans to implement an aggressive share buyback program in which it will repurchase over $7 billion in shares in the first full year, and more than $20 billion across the first three years.

Josh Young, chief investment officer and founder at Bison Interests, says in an email he likes the deal from both sides. “It is accretive, there are obvious synergies from asset overlap - particularly in South Texas and North Dakota, the deal premium is modest, and there is a clearly stated large buyback plan going forward,” he adds.

In an email, Andrew Dittmar, Principal Analyst at big data and analytics firm Enverus, says, “Combining with Marathon will boost Conoco’s market cap to above $150 billion extending its lead as the largest independent producer and placing it broadly in the same scale as majors, above BP and behind Shell.”

Keep reading with a 7-day free trial

Subscribe to Energy Transition Absurdities to keep reading this post and get 7 days of free access to the full post archives.