Devon, Coterra Merge To Create Another Shale Giant

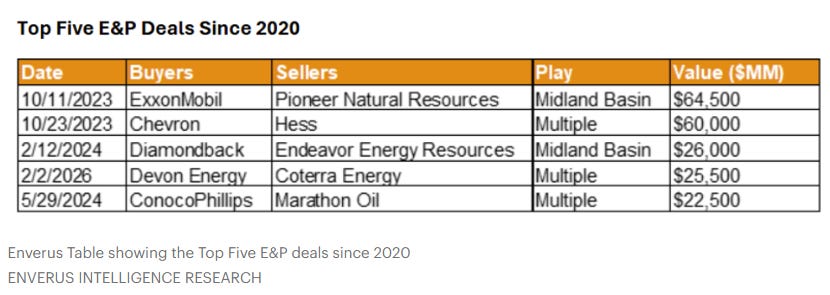

Cutting costs and boosting economies of scale have driven merger deals in the U.S. shale business for more than a decade now. Those themes are in play again with Monday’s announced merger between a pair of big Permian Basin independents, Devon Energy and Coterra Energy in an all-stock deal valued at $58 billion.

Under the deal’s terms, Coterra shareholders will receive .70 shares of Devon Energy stock in exchange for each owned share, with Devon remaining as the surviving company. With an equity value of $25.5 billion, Enverus Intelligence Research principal analyst Andrew Dittmar says the merger ranks as the fourth largest U.S. upstream M&A deals since 2020.

An Emerging Shale Powerhouse

In its release, Devon says it has identified up to $1 billion in identified pre-tax synergies which it believes will create “significant, annual free cash flow improvements.” The deal stands to make Devon a powerhouse in the prolific Delaware Basin, with more than a decade of high-quality drilling inventory.