Forbes Piece: Oil Boom 2023 - No Need For Big Changes Amid Strong Price, Demand Environment

[Note: The full piece can be read at this link.]

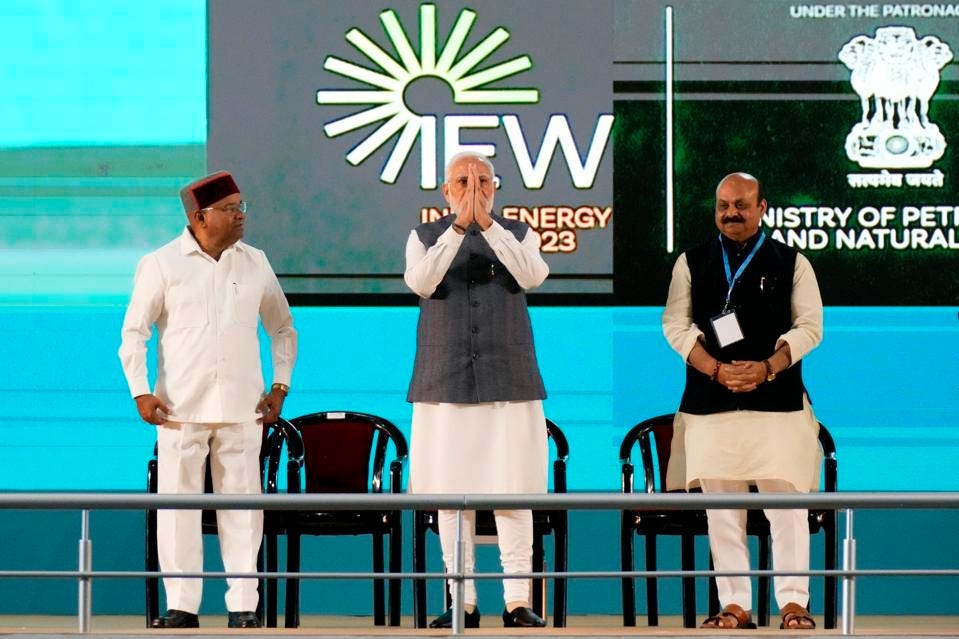

Indian Prime Minister Narendra Modi, center, greets the delegates at the 'India Energy Week 2023' in Bengaluru, India, Monday, Feb. 6, 2023. Over 500 energy industry heavyweights are expected to discuss the future of renewables and fossil fuels at th

COPYRIGHT 2023 THE ASSOCIATED PRESS. ALL RIGHTS RESERVED.

Ongoing demand growth for crude oil is largely concentrated now among the world’s developing nations amid energy transition policy focus by governments of the western world. But that’s enough to maintain robust demand and price environments globally, especially when China and India, the world’s second and third-largest economies, continue to be included on the roster of developing nations.

India has become one of the major buyers of Russian crude as Europe and the U.S. have ratcheted-up ever-stronger sanctions on the aggressor nation in retaliation for its ongoing war on Ukraine. But there will be somewhat less of such crude on the market as of March, after the Putin government said it would cut overall output by 5%, or about 500,000 barrels of oil per day (bopd).

OPEC+ Has Little Reason to Adjust

The Russian announcement came days after a technical committee of the OPEC+ cartel, of which Russia is a key member, had held its regular digital meeting. Representatives of some of the OPEC+ nations told Reuters that the Russians had not provided the group with any advance notice of the planned cut. But Bloomberg quoted delegates who preferred to not be identified said the cartel does not currently plan to implement any changes in response to the Russian move.

Amrita Sen, co-founder of consultancy Energy Aspects, told Bloomberg TV that she she expects OPEC+ to keep its production flat throughout 2023. “Having spoken to quite a few officials in Riyadh, the motto was very much to stay put this year — no changes to OPEC+ policy, regardless of the volatility we see in prices.”

A strong consensus seems to have formed among analyst projections of strong demand and price environments persisting for crude throughout the year, providing little reason for the cartel to implement changes. Russia’s cut in crude production only seems to reinforce that notion.

Goldman Sachs, for example, cut its 2023 average crude price forecast by $6 per barrel last week, but that cut lowered the forecast to a still-robust $92 per barrel, well above the reported OPEC+ target Brent price of $80/bbl. J.P. Morgan takes a similar outlook, setting its average Brent price at $90 for the year. After speaking with representatives of five OPEC+ member nations, Reuters said that three of them predicted the crude price would rise above $100/bbl for at least part of the year.

Keep reading with a 7-day free trial

Subscribe to Energy Transition Absurdities to keep reading this post and get 7 days of free access to the full post archives.