Forbes Piece: The U.S. Could Lose A Shot At Rare Earth Element Independence

[Note: This story is also published at Forbes.com]

A recent story in the Wall Street Journal chronicles the fact that, for this energy transition to succeed, the United States is going to need massive quantities of cobalt, among other energy minerals. Yet, the Australian owners of what would become the largest U.S. cobalt mine, despite having managed to overcome the myriad permitting hurdles that delay and raise costs for opening any U.S. mine, recently were forced to suspend operations and lay off employees recently due to a crash in the commodity price.

As the Journal’s authors note, China currently dominates supply chains for cobalt and most other critical energy minerals, and companies operating in the U.S. face the added obstacles of far higher environmental standards, permitting delays, activist litigation, higher labor costs and difficulty generating interest from Wall Street. The array of subsidies and tax breaks in last year’s Inflation Reduction Act were supposed to help address the financial end of things, but distribution of the funds has been a predictably plodding process within the federal bureaucracies.

The Problem For Rare Earths

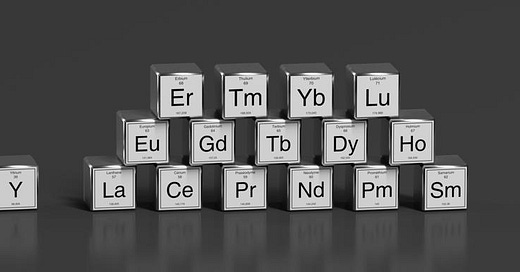

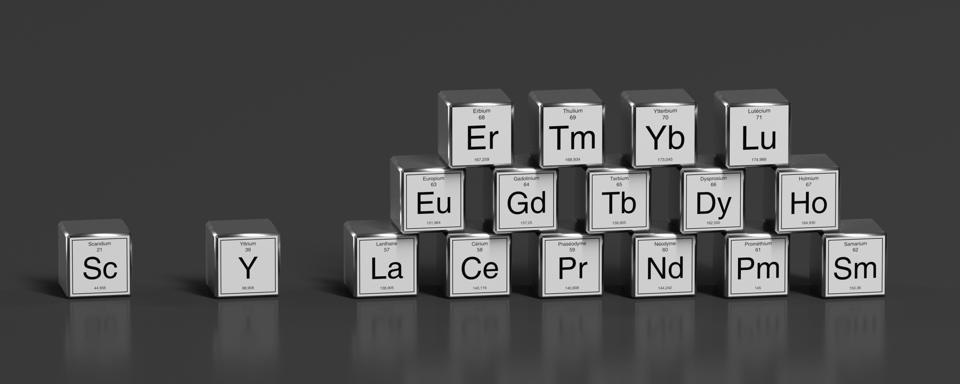

A very similar set of challenges exists in the realm of rare earth elements, where China has also dominated the supply and supply chain landscape for decades. So-called rare earth elements are those occupying element numbers from 57 to 71 on the standard periodic table. They come with names like lanthanum (La), cerium (Ce), praseodymium (Pr), and the rarest of all, thulium (Tm).

Rare earth elements have come into increasingly high demand in recent decades due to their use in basically every high tech gadget used by the human race. That demand has expanded in recent years due to the key role rare earths also play in the manufacture of batteries, wind turbine blades and solar panels.

Keep reading with a 7-day free trial

Subscribe to Energy Transition Absurdities to keep reading this post and get 7 days of free access to the full post archives.