Forbes Piece: Why Texas, Louisiana Are Poised To Win The Carbon Capture Sweepstakes

[Note: This story was also published at Forbes.com]

A refinery near the Corpus Christi Ship Channel on Monday, March 11, 2019, in Corpus Christi, Texas. - To realize America's soaring energy export ambitions, the port of Corpus Christi in Texas is pulling out all the stops. AFP VIA GETTY IMAGES

For the oil and gas industry, the success or failure of a rapidly growing carbon capture, use and storage (CCUS) sector in the U.S. and globally is shaping up to be almost a matter of survival as the world community treads down the path of the ‘energy transition.’ With so much riding on a company’s emissions profile and ESG score, CCUS has become one of the most fit for purpose means improving those metrics.

Five Factors Hold The Key

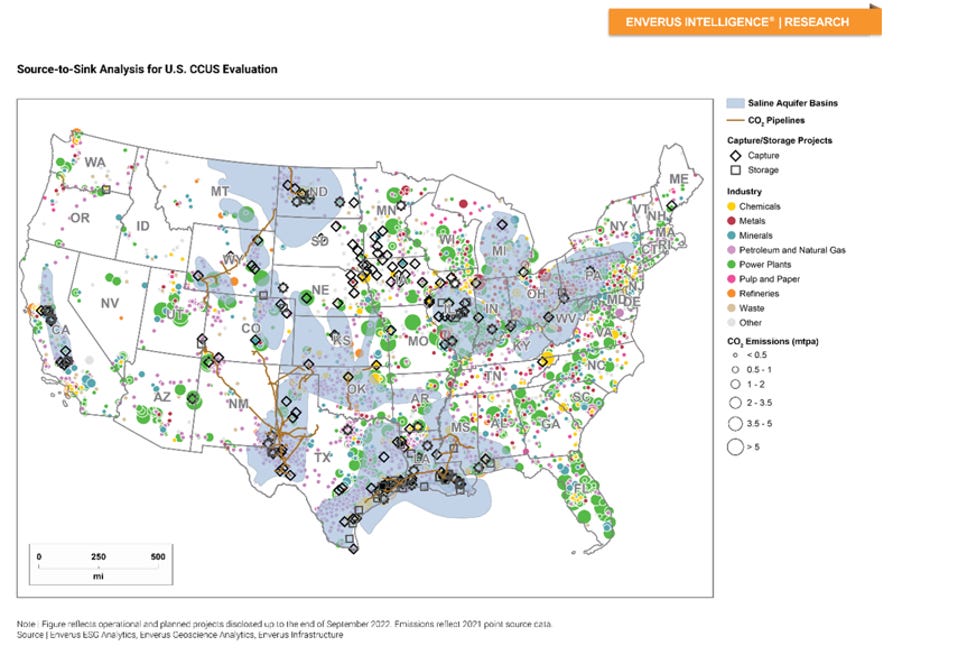

The same holds true for companies that operate heavy-emitting manufacturing facilities whose tailgate emissions are slated to become contributors to multi-party CCUS projects at major hubs in specific geographic areas. In a recent report titled CCUS Play Fundamentals, analysts at big energy information and analytics firm Enverus point out that the most successful locations for major projects will be those that can bring a specific set of factors to the table:

A large number of emitters concentrated in a compact area;

Close proximity to high-capacity underground pore space;

Necessary pipeline and other key infrastructure;

A project lead company with the internal expertise required to manage the project; and

Supportive regulatory and policy frameworks that incentivize capital to flow to CCUS.

In a recent interview, Graham Bain, vice president at EIR, a business unit at Enverus, pointed to various locations along the Texas and Lousiana Gulf Coast as potential hubs that possess the needed set of factors. “You've got, first of all, high volume clusters of emissions,” Bain says, “So if we're talking about hub, they make a lot of sense. It becomes more economically viable in terms of the infrastructure build out, pipeline connections with these hubs.”

Obviously, cost is a big factor. “The second piece of that is these are all low capture cost emissions,” Bain continues. “They're all fairly pure streams of CO2 looking at chemicals, refineries, which we view as having a lower capture breakeven. A third piece to that is the the price of electricity to capture the CO2. Electric prices are lower in Texas and across the Gulf Coast region.”

No potential hub along the Gulf Coast serves as home to a more concentrated number of refineries, chemical plants and other manufacturing installations than the Houston/Galveston area. That region, along with the Corpus Christi area further South, are the focus of EIR’s initial report because the Texas General Land Office, which owns the potential offshore pore space where the CO2 would be stored, kicked off a request for proposals process focused on those two areas on March 9.

Keep reading with a 7-day free trial

Subscribe to Energy Transition Absurdities to keep reading this post and get 7 days of free access to the full post archives.