Net Zero by 2050 is a Dead Concept. Here's Why.

A recent flurry of forecasts offers us a range of different views on what’s happening to the global demand for, and use of, crude oil. One thing seems to be clear, however: the chances of net zero carbon emissions in the near term – ie, by 2050 – are basically zero.

The year so far has been a bit of a rollercoaster ride in this realm of uncertainty, with projections and forecasts more volatile than the market itself. Crude prices have remained relatively strong despite various occurrences across Europe and the Middle East that would have resulted in major upsets in decades past.

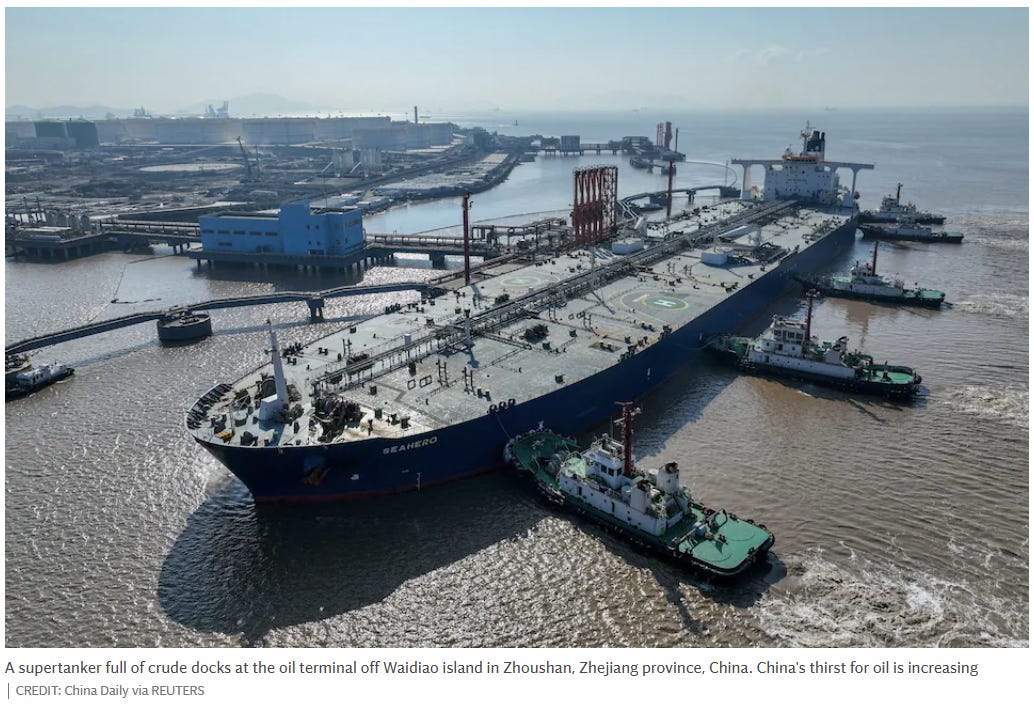

One major point of consensus related to global oil demand growth is the expectation that it will continue to be robust, driven by a combination of factors including economic recovery, increased travel, and surging industrial activity in non-OECD nations.

The only major body not seeing continued, massive growth is the International Energy Agency (IEA), which revised its numbers this week to predict that crude demand will rise by just 1 million barrels per day (bpd) next year and will peak “towards the end of this decade” at 106 million bpd, up from 102 million at the moment. The IEA expects this growth to be led by non-OECD countries, particularly China and India. The IEA and others have highlighted the importance of these regions in driving global oil demand.

Keep reading with a 7-day free trial

Subscribe to David Blackmon's Energy Additions to keep reading this post and get 7 days of free access to the full post archives.