The only truly predictable thing about predicting oil prices is that they are stubbornly unpredictable. Anyone able to accurately and consistently predict the direction of oil prices would soon become a billionaire by trading in the commodity.

I learned that lesson for about the 100th time this week when, one day after I wrote a piece about the potential price-depressing impacts from an apparent shift in strategic direction by Saudi Arabia on October 1, oil prices began shooting up in the wake of Iran’s decision to launch a ballistic missile attack into Israel. As of this writing on the morning of October 4, the international Brent price for crude oil is up 11% for the week and still rising in Friday trading.

Oil markets have remained unusually stable over the past year since the October 7, 2023 attacks by Hamas on Israel, mainly due to the lack of any threat to the free flow of oil out of the Persian Gulf. But the prospect of Israel launching a major retaliation that would target Iran’s oil production and export infrastructure has traders on higher alert.

Where will oil prices go from here? As always, that is anyone’s guess, and guesses are the only things available to us. Prices will rise or drop based on a wide variety of factors, including the following:

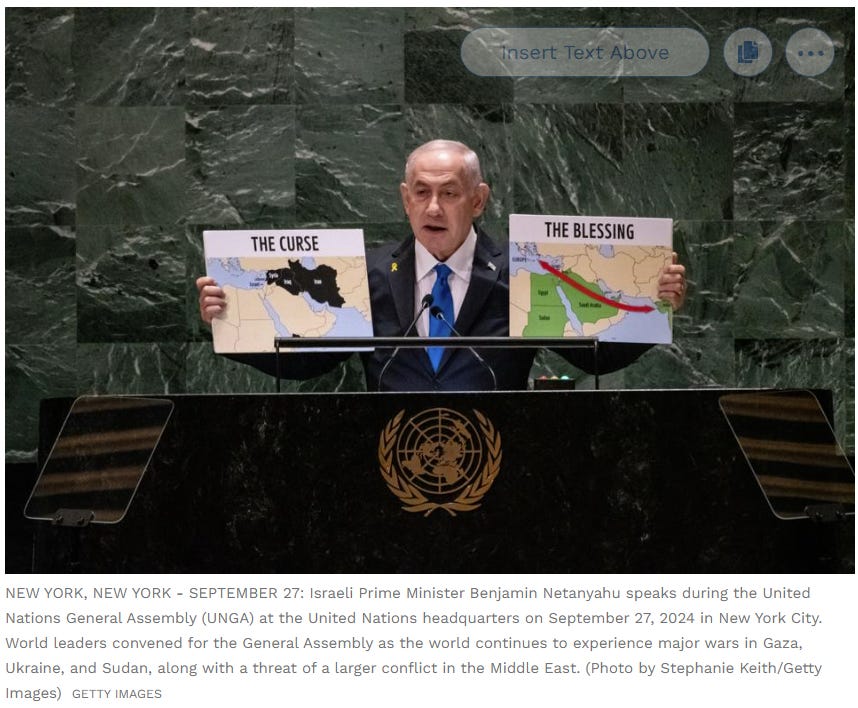

Will Israel retaliate, and what would such a countermove look like? - Israel’s Prime Minister, Benjamin Netanyahu, vowed to retaliate directly against Iran in the wake of the missile attack, saying his government will adhere to “the rule we established: Whoever attacks, we will attack them."

Keep reading with a 7-day free trial

Subscribe to Energy Transition Absurdities to keep reading this post and get 7 days of free access to the full post archives.