In an interview last week with Swiss publication NZZ, S&P Global Vice Chairman Daniel Yergin said he is “sick of the energy transition,” adding, “ It sometimes loses touch with economic history and reality. If you look at the history of energy transitions, they all last for over a century. To try and make change happen in 25 years, or even half of that time is highly unlikely.”

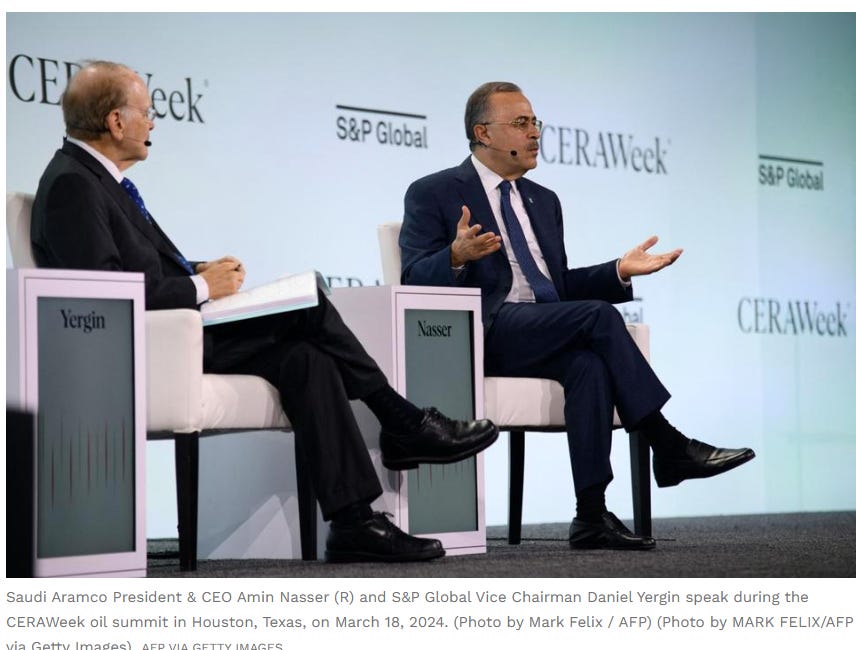

This week, Yergin is performing his annual duties as host of the CERAWeek event, where energy industry leaders and political figures are gathered to discuss the pressing issues impacting the global energy space. If remarks by presenters thus far are any indication, Yergin is far from alone in his becoming tired of the prevailing narratives surrounding this government-subsidized transition and its impacts on society.

Indeed, one prevailing theme that emerged over the event’s first two days is of the big players in the oil and gas sector becoming increasingly skeptical of the viability of emerging government policies and rededicating their companies to further development of their core business endeavors. Speaking on Monday, Amin Nasser, CEO of the world’s biggest oil and gas company, Saudi Aramco, called plans to phase out oil and gas “a fantasy,” and said the transition is “visibly failing.”

“We should abandon the fantasy of phasing out oil and gas, and instead invest in them adequately, reflecting realistic demand assumptions, as long as essential,” he said.

Keep reading with a 7-day free trial

Subscribe to Energy Transition Absurdities to keep reading this post and get 7 days of free access to the full post archives.