Yesterday’s announced buyout of privately held Endeavor Energy Resources by Diamondback Energy is the latest in a long series of mergers and acquisitions that have rapidly consolidated most Permian Basin production into the hands of a handful of very large firms.

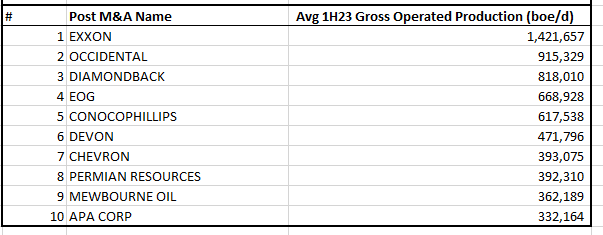

The folks at Enverus sent over this table showing the 10 biggest remaining Permian producers following the Diamondback/Endeavor deal:

One question that always arises in the wake of one of these huge deals is, who is left to be bought? In the piece I wrote for Forbes on the deal, I quote Enverus SVP Andrew Dittmar as pointing to venerable privately-held Texas firm Mewbourne Oil as the next likely candidate with a big Permian asset base, along with smaller holdings in the Anadarko Basin, and you can see it sitting there right below Permian Resources on this pecking order chart. For companies looking for a Permian-centric deal, Mewbourne now stands out as ripe for the picking, assuming its owners want to sell.

Keep reading with a 7-day free trial

Subscribe to Energy Transition Absurdities to keep reading this post and get 7 days of free access to the full post archives.