Texas Is Flush With Money, Largely Thanks To Oil And Gas

[Note: This story was previously published at Forbes.com]

Since the initial discovery of oil at Spindletop on January 10, 1901, the financial fortunes of Texas state government have tended to ebb and flow with the fortunes of the state’s oil and gas industry. In his biennial official state revenue estimate that precedes each legislative session, Texas Comptroller Glenn Hegar showed that, 122 years later, that relationship has not changed.

[Follow me on Twitter at @EnergyAbsurdity]

On Monday, Hegar delivered the best budget news in the state’s history. The Comptroller reported that legislators will have a record budget surplus of $32.7 billion to work with as they formulate the state’s budget for the 2024-25 biennium.

Writing in the Austin American Statesman, Hegar attributed much of the credit for the happy revenue situation to the state’s oil and gas industry. “Texas revenues over the last 18 months have been remarkable,” Hegar says. “Only three times in the last 30 years has Texas total tax collection grown by double digits over the previous year. Those three increases range from 10 to 13%. By comparison, last year’s increase was a whopping 25.6%...with staggering growth from oil and gas severance taxes.”

The growth in state severance tax collections is not surprising, given that the tax is assessed on the sales value of the production, not as a percentage of volume as is the case in some other states. Thus, the high commodity prices for both oil and natural gas during 2022 were big drivers of this increase.

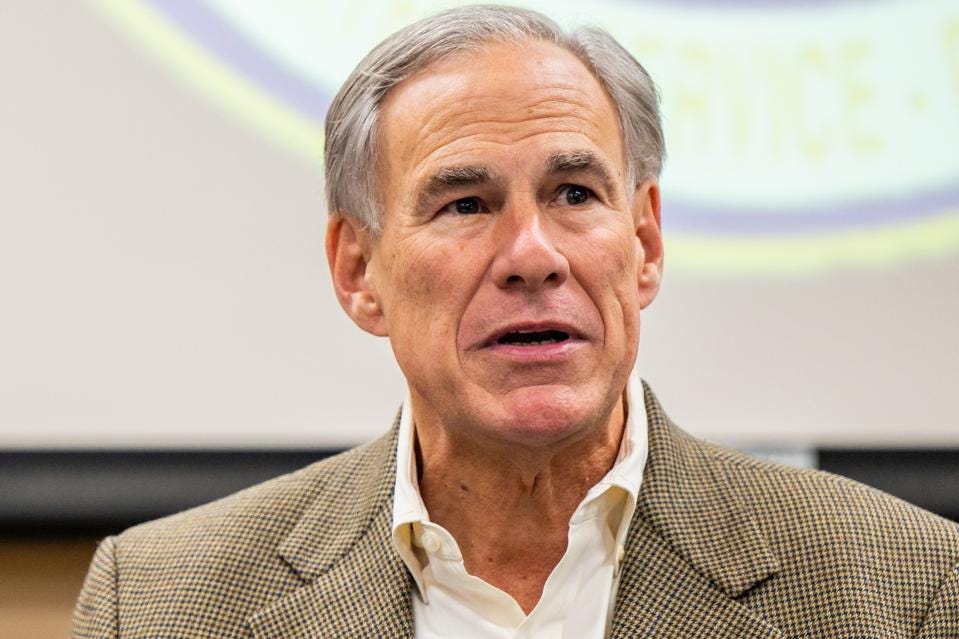

It is key to note that these severance taxes on oil and natural gas also constitute the main funding mechanism for the state’s Rainy Day Fund. Hegar reported that the current balance in that fund is roughly $13 billion, but projects it could rise to as much as $27 billion during the 2024-25 biennium. When combined with the projected $32.7 billion surplus, this provides the legislature and Governor Greg Abbott with an unprecedented level of financial flexibility to address the state’s funding priorities in the coming years.

...Insert Text Above

Jason Modglin, President of the Texas Alliance of Energy Producers, emphasized that in a statement on Tuesday. “Those funds will rightly be used by the legislature to provide tax relief, fund roads, schools and healthcare,” Modglin said. “The Alliance will be working to support policies during the session that will maintain and grow oil and gas production. The best ways to do that are by properly funding sound regulation and regulators, keeping taxes low, and continuing to attract jobs and investment to Texas.”

Ed Longanecker, President of the Texas Independent Producers and Royalty Owners Association (TIPRO), said “We hope the legislature will consider additional funding for roads and infrastructure investments in energy producing areas, produced water pilot projects and testing, seismicity research and monitoring and funding requests from the Texas Railroad Commission for IT, vehicles, and employees. These types of investments will help to ensure that our industry continues to provide its outsized contributions to the Texas economy.”

Keep reading with a 7-day free trial

Subscribe to Energy Transition Absurdities to keep reading this post and get 7 days of free access to the full post archives.