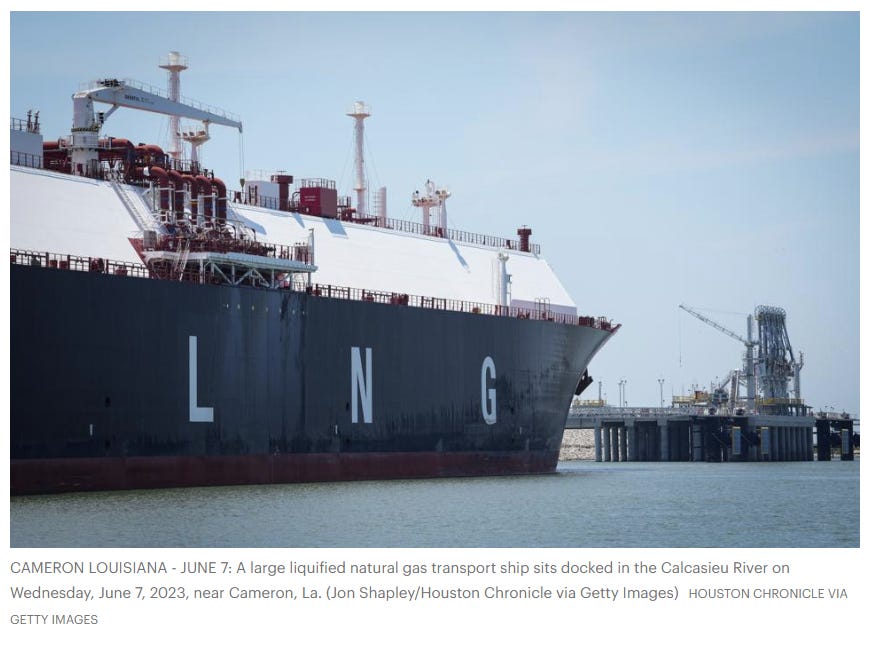

Shares of liquefied natural gas (LNG) exporter Venture Global, Inc. began trading on the New York Stock Exchange Friday following the launch of an initial public offering valued at $1.75 billion. Thursday’s IPO included the offering of 70 million shares of Class A common stock at an initial price of $25 per share.

With a total initial market cap of $65 billion, Venture Global (VG) becomes the largest energy IPO by valuation in U.S. history and just the sixth US company to debut with a market cap of $60 billion or more. The IPO was launched just three days after Donald Trump was inaugurated as the 47th President of the United States, following a campaign in which he promised to fully unleash America’s oil and natural gas industry.

Trump Reverses Biden’s LNG Permitting Pause

As one of his first actions, Trump signed an executive order reversing Joe Biden’s pause in LNG permitting, returning this American growth industry to normal order following a year of uncertainty. This return to normalcy will enable the U.S. to fully meet commitments to allies in Europe, Asia and other global markets to deliver natural gas for their own energy and economic needs.

Keep reading with a 7-day free trial

Subscribe to Energy Transition Absurdities to keep reading this post and get 7 days of free access to the full post archives.